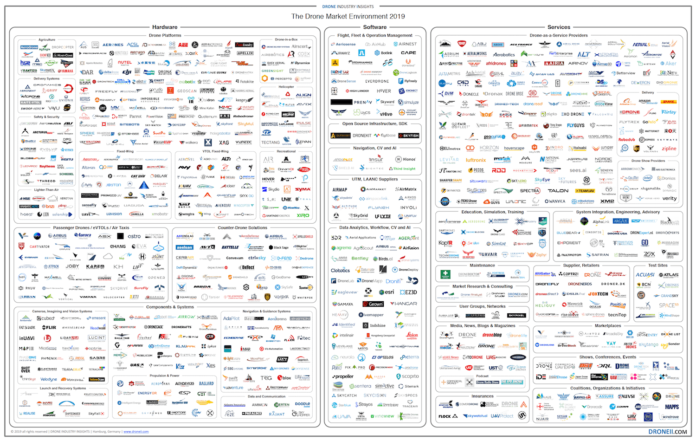

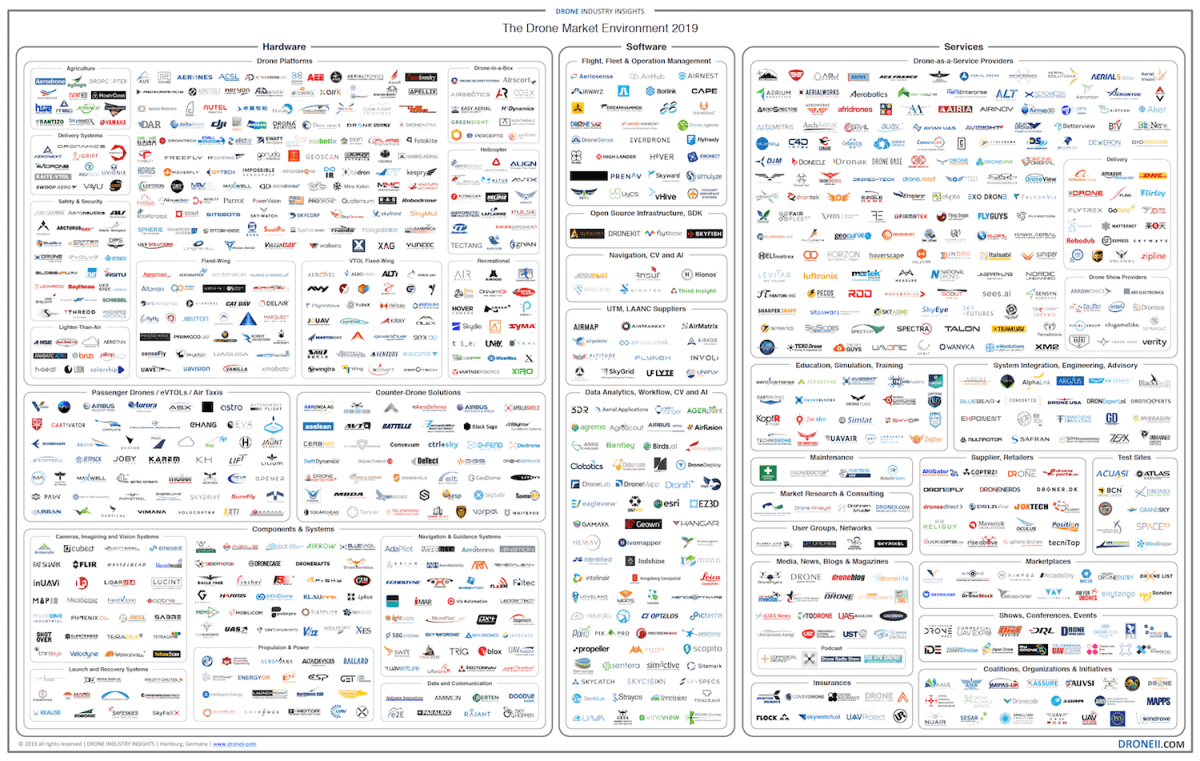

Industry Update: The Drone Market Environment Map 2019

![]()

The Drone Market Environment Map 2019 is the 4th edition of our flagship free resource, giving you the most relevant snapshot of the global commercial drone industry. In our latest edition we bring you several improvements. Firstly, we have become stricter about who we include in our map – as of now only companies, organisations, events and associations whose core business is in drones and/or those who play an important role in the drone market are on our map.

Another way which we have improved our map is by making it more transparent and democratic! In order to make acquiring a spot on the map accessible to everyone we introduced a system whereby companies can reserve a spot on the map for a small handling fee ensuring that they’ll be featured. The response to this initiative has been overwhelmingly positive which means that in 2019 we have the most versatile map yet. This has given SMEs and start-ups from all over the world a chance to be featured next to major players in the drone industry.

Originally published: June 2019

Index

Hardware: Passenger Drones and Counter-Drone Solutions Steal the Spotlight

Within the hardware segment passenger drones (eVTOLs/air taxis) and counter-drone companies have been the most talked about. As of this year there are nearly 200 concepts within the passenger drones field and an increasing number of conferences are featuring urban aerial mobility (UAM) discussions and even the first demos. Meanwhile, recent incidents at Gatwick, Heathrow, Frankfurt, Dubai, Singapore and many other airports have sparked increased interest in counter-drone technology. Since the end of 2018, the media has put the spotlight on counter-drone technology. Unsurprisingly, in our Drone Industry Barometer 2019 counter-drone companies were the most optimistic about business in the coming year.

As for platform manufacturers, the changes in the map largely depict a consolidation story – larger companies bought out smaller ones with potential and other companies ran out of time or money. For example, AeroVironment acquired Pulse Aerospace ($25.7m) and Flir Systems acquired Aeryon Labs ($200m). Another notable trend is specialisation of hardware products. Nowadays, hardware manufacturers offer increasingly niche products like delivery systems, drone-in-a-box solutions, and more.

Meanwhile, components & systems manufacturers are (as our Drone Industry Barometer noted) spending more and more money on marketing & sales. This means that either 1) the industry has matured enough that they now have polished products ready for mass sales; or 2) they are simply struggling to sell their products. There can, of course, be no discussion of drone hardware without the mention of market leader DJI. Since DJI have not announced any new recreational products this year, we can now assume that they will increase their focus on commercial products.

Software: The Race to E2E

As seen in our Drone Market Report, software is the fastest growing segment of the drone market. To this day, people still underestimate the sheer amount of data that drones collect and the tools that are needed to manage that data. Software businesses have emerged to fill that demand and due to the virtual nature of their business they have been able to scale quicker more easily and to access new markets with few barriers. Meanwhile, not only are software businesses scaling up, but they are expanding their portfolios. Today computer vision (CV) and artificial intelligence (AI) are consistently being used to streamline drone data analytics.

Thanks to software innovation in the drone industry, it is possible that task-specific software solutions will evolve into all-in-one solutions. This would mean that in a few years there would be no more software sub-segments left as companies aim to offer operation management systems (i.e. ERP systems) for drones.

The investments into software reflect optimism about the fastest growing drone market segment. For example, late last year in just their Seed Round Swiss company Auterion was able to raise $10 million. Meanwhile, the Chinese Clobotics raised $11 million in a Series A funding round, and DFS bought into Unifly for $13 million.

“Everything that can be automated will be automated. Drones are one of the most affordable and accessible tools for automation as they are there to make profit from day 1.”

Kay Wackwitz, CEO and Founder of DRONEII

Services: In Diversity There’s Strength

The drone services market is the largest segment in the commercial drone industry. Thanks to our new approach of allowing companies to reserve their seats, this year we have many more service providers than we have had previously as companies which have saved their seat on the map in the past couple of months have provided for a very diverse snapshot. The service portion of the map is larger than before in order to be able to show the drone service market in its versatility. Much like hardware companies a few years ago, service companies continue to professionalise. While at first many drone service companies sought to target multiple applications and verticals at once, they are now narrowing down their focus to produce more niche solutions.

Marketplaces continue to expand on the commercial drone market. Currently there are three kinds of marketplaces: those for pilots, data (video and pictures), and those for hardware. These matchmaking platforms have great potential to become drone operators. For example, some companies transformed from marketplaces to drone as a service providers which work based on a freelance pilot network. Another service sub-segment, insurance, is growing steadily. This is largely because an increasing number of drone regulations across the globe now mandate that all commercial drones be insured (as seen in our Drone Regulation Report 2019).

Finally, what we’ve seen, not just in the services segment but across the board, is a major improvement in the quality of marketing and branding of drone companies. This reflects industry maturity. It is also not a surprise as we’ve already learned that companies are spending increasing amounts on sales & marketing, and from our drone job market research that drone companies are increasingly hiring for sales and marketing professionals.

The best companies in the service industry, just like in the hardware industry, are now being snapped up by larger corporations as part of the market consolidation process (e.g. ICR Integrity acquiring Sky-Futures Partners). Meanwhile, rapidly growing drone service companies are also expanding into new markets and as a result of that buying up smaller players (e.g. Japanese Terra Drone acquiring a majority stake in Skeye to set up their European HQ).

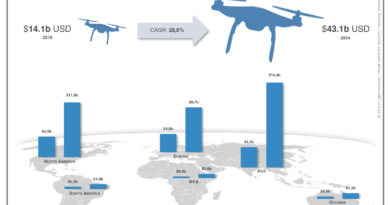

- The global drone market will grow from $14 billion in 2018 to over $43 billion in 2024 at a CAGR of 20,5%.

- Service is and will continue to be the largest segment of the drone industry, but software is the fastest growing.

- Having legalized drones in December 2018, India will be by far the fastest growing commercial drone market in the world, by 2024 becoming the 3rd largest commercial drone market.

What Now?

Our latest Drone Market Environment Map undoubtedly reflects a maturing drone market currently in the phase of consolidation. What we will continue to see in the coming year is:

- Companies will keep pulling services in-house to keep control over critical data which they either need immediately or want to keep private.

- Bigger deals, but fewer deals. Angel investments won’t stop, but we do know that they’re in decline. Instead we’re seeing an increase in larger VC deals – already this year the healthcare delivery leader, Zipline, secured a $190 million investment.

- Big players will keep opening regulatory doors for smaller ones. Thanks to market consolidation and accumulated experience larger players on the drone market will increasingly be able to get the necessary waivers and exemptions and to experiment with more complex missions therefore opening doors for those around them to follow in their footsteps.

As the drone market continues to consolidate and major players broaden their portfolios, we notice that they are already beginning to venture across segment lines. This means that for those larger companies, the hardware/software/services segregation will no longer apply in the future. Instead, we expect to see them competing to deliver end-to-end solutions to their clients. This is great news for the future of the drone market as E2E solutions will be the ultimate proof of concept for drone technology, taking away any doubts about its relevance.