Ezetap, racing against bigger rivals like Paytm, just raised $16 million in fresh funding

There are more than 1 billion cellphone users in India, which abruptly went cashless last November, when Prime Minister Narendra Modi announced that millions of high-denomination currency notes would no longer be legal tender.

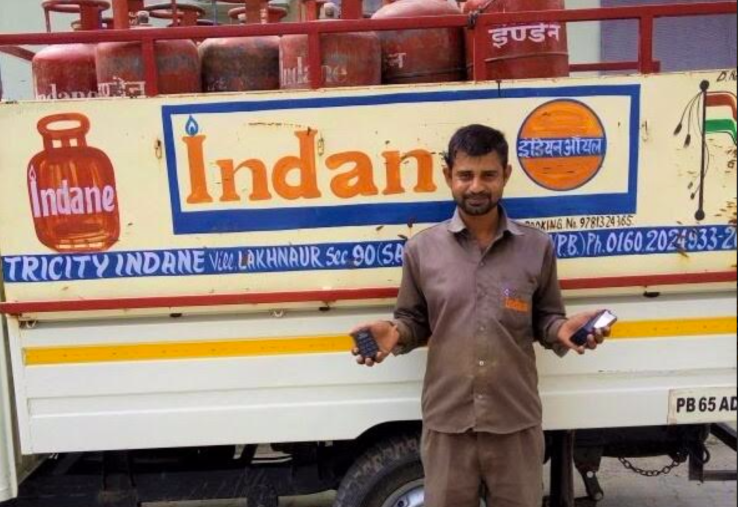

These two developments play nicely into the vision of Ezetap, a six-year-old, Bangalore-based startup whose software as a service is used by more than 200,000 merchants; they’re using its technology to transact payments via everything from physical cards to online payments to wallets to one-click payments in applications via India’s new UPI system.

Indeed, Ezetap and its ilk, which were once seen as innovators, are quickly becoming mainstream, with Indians being forced to switch to electronic payments quickly.

The company’s biggest challenge now: capturing market share from its better-known and more richly funded regional competitors, including the Alibaba and SoftBank-backed outfit Paytm, whose parent company was recently valued at $7 billion; and MobiKwik, which reportedly raised around $35 million earlier this month from the non-bank finance company Bajaj Auto Finance.

Investors seem to think Ezetap has a shot against its deeper-pocketed rivals. The company just closed on $16 million in new funding led by JS Capital Management, the venture firm of Jonathan Soros, with participation from Jeff Skoll Group, along with earlier backers Social Capital and Horizons Ventures.

“India is on the brink of a massive surge in consumer consumption, but not until the underlying payments infrastructure is securely in place,” Social Capital founder Chamath Palihapitiya said in a statement to the press about Ezetap, whose $3.5 million Series A round Social Capital led back in 2012.

That puts the company “in an incredible position,” Palihapitiya said.

Time will tell.

Ezetap, which employs 200 people, has now raised $51 million altogether.

It has also made two acquisitions to date. In June, it snagged FortunePay, a Bangalore-based startup that offered payment switching infrastructure to banks. It also acquired a loyalty platform called Clinknow in 2014. Terms of both deals were not disclosed.

In a chat earlier this week with co-founder and CEO Abhijit “Bobby” Bose, he told us that Ezetap is now processing $135 million in transactions monthly, eight times more than it was at the start of 2016. He says the firm is on track to triple its volume over the next 18 months, too.

Bose also said the company, whose underlying payments structure is largely complete for now, doesn’t need to hire many new people in order to grow quickly. At least, he said, rather than add to Ezetap’s engineering department, new hires will be focused around marketing and sales and to help Ezetap launch in Southeast Asia by the end of the year.

“The business model is ramping up,” Bose told us. “With $1.5 billion per year flowing through [our platform] and what we expect will be more than $3 billion in the next 12 months, we’ll be profitable soon.”

Tech in India, he’d added, is “moving at a ridiculous pace.”