Five billion-dollar businesses for the driverless future

Massive opportunities in urban transportation are emerging as the industry transitions from per-vehicle to per-mile economics

Growing up, I dreamed of owning cars I would be proud to wax, polish, and cruise around my neighborhood. Today, I dread the prospect of being weighed down by a rapidly depreciating hunk of plastic and metal. Now all I want is a pleasant transportation experience.

Millennials share my sentiment toward vehicle ownership, and many of them are embracing the convenience of ride sharing.

The trillion-dollar auto industry is being turned on its head. Automotive companies are getting squeezed as car sales drop and newcomers eat their margins.

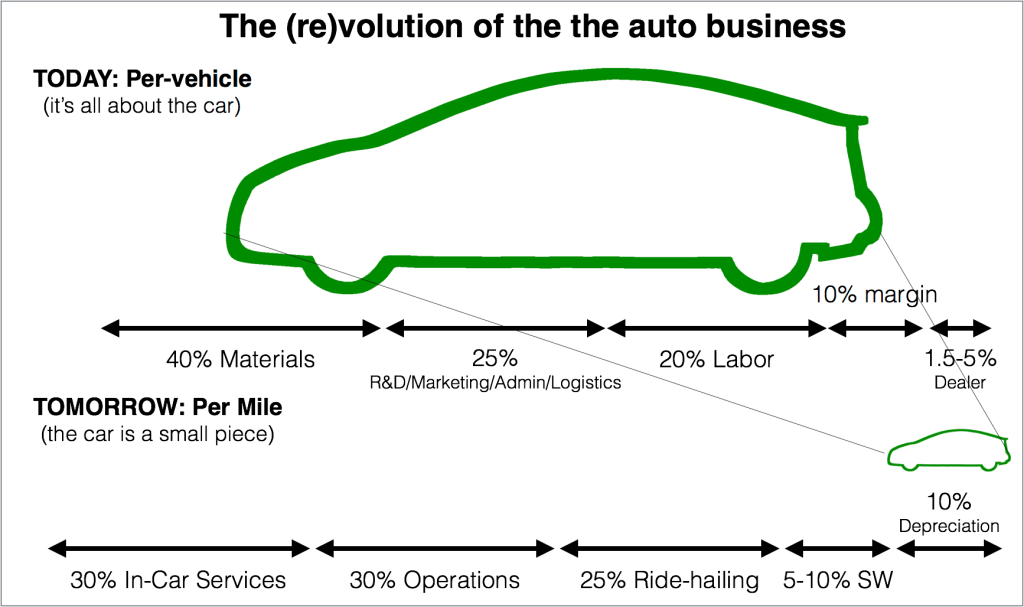

As part of this shift, the industry is transitioning from per-vehicle to per-mile economics. Historically, the automotive industry has been measured by how quickly it assembles cars, pushes them to customers, lends money against them, and collects money to maintain and upgrade them.

Tomorrow, the industry will be measured by how many miles it moves passengers, and how much margin it generates on every mile traveled.

Vehicles will travel 3.17 trillion miles in 2017 — a 7.8% increase from five years ago. The trend will continue: The rise of electric vehicles and automated driving mean we can expect a lower environmental and labor impact, as well as lower prices.

Automakers should not worry about being put out of business. Some will not survive the evolution. A but a number of them will be key players in tomorrow’s per-mile realm. Some will become white-label, commodity producers of vehicles for Uber, Lyft, or Zoox fleets. Others, such as GM, Audi, and BMW, may choose to compete with the ride-sharing giants and operate their own fleets.

In the driverless future, traditional car companies will get less of the margin for every mile traveled by consumers. Emerging services will usurp the rest.

Which businesses are positioned to capture the majority of the dollars for the many billions of miles driven? A few possibilities:

- Insurance: Robo-taxi technology has almost arrived. So far, there isn’t a legal framework in which an operator can offer autonomous services. Such a framework would help to set limits on the liabilities of passengers, operators, and technology vendors. When the limits of those liabilities are known, insurers can design and offer policies for each group. Startups will need to take a leadership role in helping insurance companies model the risk of computer vision, AI and other technology malfunctioning. Given the expectation of slower auto sales, incumbent insurance companies should be delighted to pursue this nascent market, which could turn into the bulk of their business someday.

- Compliance: Limiting operators’ liabilities will require strict safety regulation compliance. These regulations could include building and running simulations on the AI, as well as monitoring and auditing tele-operations (i.e., humans remotely overseeing the autonomous vehicles).

- Distribution: Today, Uber and Lyft own the primary channels to ridesharing. Their vast network of drivers and colossal cash coffers have allowed them to lock down the industry and squash competitors. So far, neither of them is building their own vehicles. Traditional automakers have an opportunity to rethink the experience of passengers, as well. If they start from first principles, they will find themselves designing and building very different vehicles than what they’ve made in the past. New and emerging companies, such as Zoox (disclosure: my firm is an investor), are being built from the ground up to design and operate sophisticated transportation robots for this new era of driverless transportation.

- In-vehicle services: Forget mobile devices; “driverless” is the new platform. Highly personalized, rich environments can be created to stimulate and engage with passengers. Voice interfaces can tune the experience in the vehicle, and serve as a concierge for not only that a single trip or a series of trips over multiple vehicles and in multiple locales. Imagine tours provided by robotic cars that “know” passenger tastes, preferences, and previous destinations. Your driverless tour guide showing you around Bangkok “knows” your preferences from your prior tours in Rome and Sao Paulo. They can tap into your social media profile to recommend dining, shopping and entertainment experiences.

- Autonomous technology: It is well-established that companies who build unique technology that enables autonomous driving are positioned to reap massive benefits. Non-auto-tech companies are seeing the opportunity and snapping up innovative companies. Intel paid a premium for MobileEye and positioned itself as a major Tier 2 automotive supplier. The channel that Intel acquired through this purchase will enable Intel to sell many other technologies, such as chips, sensors, and software, into the automotive supply chain.

Trillions of dollars worth of new opportunities abound in the coming era of autonomous travel. If history has taught me anything, it’s that this new paradigm will spur entirely new ways of living that we haven’t yet considered. As for myself?

As a gearhead, I’m most looking forward to getting from A to B by robot, and manually pushing performance cars to their limits on racetracks.

Featured Image: David Butow/Corbis/Getty Images