Jeff Bezos should totally buy a coffee startup

The benefits of Amazon’s $13.7 billion acquisition of Whole Foods more or less went live this week, with price cuts out the wazoo as well as a bunch of Amazon Echo devices available for sale in stores. With this massive move into grocery chains and the obvious branding play, as well as tangential benefits like suddenly getting access to hundreds of locations with fresh ingredients that may or may not go into meal-kit delivery, it’s time to start asking: where won’t Amazon go?

I’ll take a crack at something that wouldn’t be a surprise if it’s flying around the office in Seattle: whether or not Amazon should buy one of the increasingly popular coffee start-ups that’s attracted a lot of venture financing.

To kick things off, just imagine that for every Starbucks or Peet’s there’s a Blue Bottle or Philz across the street. Those coffee shops have a brand that’s not associated grabbing your latte and jumping out. They are, instead, focused more on some sense of the art of good coffee (as weird as that sounds) and they have an opportunity to capture a higher-value customer. Now, grow that vision to the thousands of Starbucks coffee shops around the world along with the resources that Amazon could potentially pour into it with carte blanche from Wall Street.

And, there are so many options to choose from. Just walk down Valencia street in San Francisco (or, if you aren’t in this wild hipster bubble, do some googling) and you’ll see far too many options from which to choose. Most have raised some kind of venture financing: Blue Bottle raised $70 million a few years ago; Philz did a $45 million financing round last year. There are other coffee providers like Ritual Coffee, Four Barrel and Sightglass, all of which goes to show that there is an insatiable taste for unique experiences. All of these seem to be growing with new stores coming in every so often (including the periodic VERY Apple Store-esque Blue Bottle) and this coffee craze doesn’t seem to be going anywhere.

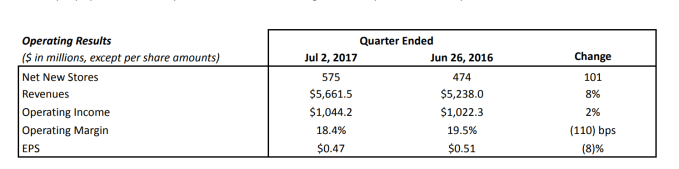

Starbucks in its most-recent operating quarter also posted an 18.4% operating margin as it continued to add hundreds of new stores. That means for every billion dollars in revenue, it’s minting hundreds of millions of dollars in a profit that it can drive directly into new stores and growth. But Starbucks, as a public company, is beholden to its shareholders and might not have the same luxury or room that Amazon has to gleefully burn cash and still charge toward being a trillion-dollar company.

Looking at the slash line for this company, Starbucks has built a very impressive business built on top of a very impressive brand, not to mention the tech to order ahead to run in and immediately grab a semi-decent iced latte. It’s also shown a euphoric willingness to expand into the latest trends of coffee, with fresh cold brew options or an alarming number of flavor syrups for your typical espresso drink:

While most of these coffee start-ups seem very popular in select markets, and the Whole Foods business was definitely more mature than any of these startups, the grocery chain was still really a strong millennial brand going up against traditional grocers like Safeway or Kroger. Still, just given how many companies there are, and how much money they have raised, it would seem there’s quite a bit of room for all of these to grow on their own and remain independent.

Buying a coffee chain would be a classic Amazon move: find a market that represents the opportunity to expand the Amazon brand and then bulldoze into it with reckless abandon. It can then apply the overwhelming scale it has to both supply the kinds of weekly or bi-weekly subscriptions these shops have while embedding free awareness of the Amazon brand within those coffee shops. There’s a risk of diluting the super-hipster high-value brand of Philz or Blue Bottle, but given that Amazon is a Very Great Tech Company, that seems almost unlikely.

Amazon is probably done pulling out the checkbook for a while. And yet, to buy Whole Foods, Amazon said it would make a debt offering in order to get enough capital to pull it off. This isn’t a super-uncommon practice as big companies look to do big acquisitions, and it seems like Amazon could easily pull off some financial gymnastics to shell out the required cash to pick up one of the many, many coffee start-ups out there.

Also, all of the above are pretty delicious and would be even greater if they weren’t quite as expensive. But, that’s none of my business

Featured Image: Drew Angerer/Getty Images