Beyond Amazon and Alibaba: what’s next for e-commerce?

How do you outsmart an 800 lb gorilla? E-commerce retailers in the two biggest markets – China and the U.S. – grapple with this question every day.

Many assume the e-commerce game is over given the immense success of Amazon and Alibaba (both have $400+B market caps). Amazon has systematically commoditized product category after product category – books, houseware, electronics, clothing, grocery and more, while Alibaba’s Tmall and Taobao platforms have captured market share and popular imagination with millions of SKUs, truly creating a global “everything store.”

But declaring game-over in these markets is a mistake. A careful read of emerging trends reveals rich greenfield territory, where billion dollar start-ups can thrive by recognizing the opportunities of global mass market of millennials from day one. I’ve written more on millennial buying habits here.

Key to understanding these emerging trends is a redefinition of what we mean by ‘mass market’. Historically, in a time where buyers and sellers were geographically constrained, serving the mass market meant selling nearly every good in every vertical at the lowest possible price point – essentially, creating ‘the everything store’ with ‘everyday low prices’.

This is no longer true in today’s smart phone-enabled world. The global mass market largely influenced by millennial buying habits and priorities as well as the consumer upgrade happening in China in which consumers are “upgrading” their lifestyle through travel, household goods, fashion, dining and more, are seeking out affordable luxury – unique products at low prices.

New e-brands like Dollar Shave Club and 73Hours, a women’s shoe brand in China, and vertical marketplaces like Houzz for home decorating and remodeling, DarbySmart for crafters or Red/Xiaohongshu, the go-to site for beauty products in China have seen tremendous growth thanks to their ability to deliver a vastly improved consumer experience. Both e-brands and vertical marketplaces are using curation, personalization and community to prevail in the U.S. and China markets.

Curation vs. the Warehouse

Differentiating from the guerillas begins with search vs. discovery. Amazon and Taobao are giant virtual warehouses that rely upon purpose-based shopping. Consumers visit these sites to find a product they know they want, and can buy for a low price. Consumers log on, search for an item, buy it and leave. Free shipping and next day delivery aside, the experience is too sterile or too cluttered for absent-minded browsing on smartphones.

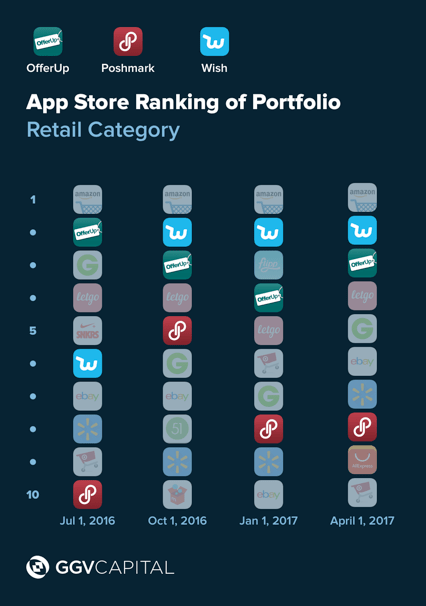

E-brands and vertical marketplaces aren’t going to compete with this kind of warehouse search. Instead, they focus on discovery – curating a body of products in a specific category that customers want to peruse and occasionally purchase. Mobile shopping is becoming entertainment, and a well curated group of products makes for a more enjoyable experience. Online brands are approaching curation in different ways and their popularity is evident in the app store.

Products can be curated by professionals – as with Houzz, a social commerce platform for designing your home. Or by KOLs (key opinion leaders) on sites such as with Poshmark where other users recommend new looks. Still others are curated by price – as with Hollar and Wish, an app that offers users an elegant stream of insanely discounted goods, and LetGo or OfferUp, Craigslist style resale apps built for easy browsing.

None of these apps target the shoppers who feel they need access to every single product right now. But they do offer consumers a curated experience – by product or price – to discover affordable luxury products in apps built for the endless entertainment of smartphone users.

The Personal is Social

As much as consumers may love Amazon and Taobao, consumers fundamentally see them as tools, not identities. They will be used for what they are useful for, but you won’t find many users turning to these brands for social identity-creation.

Successful e-brands and vertical marketplaces such as AirBnB, Xiaohongshu, Pinterest and Houzz are expert at creating a social following, creating both inspirational and aspirational sense of community. They win by turning their communities and values into cultural cachet, and engender loyalty in consumers precisely because those users feel shopping in the app equates to membership in a sub-culture. Personalization of products and cultivation of community then drive users to project these brands outwards on social media. This is happening in both the US and China.

Some e-commerce upstarts achieve this through value-infused branding, as with Lively, a for-women-by-women lingerie brand that celebrates natural body types, Dirty Lemon, a new kind of beverage, or Function of Beauty, personalized shampoo and conditioner.

Some do it through iterative tailoring to a user’s tastes, as with StitchFix and Dia, subscription clothing delivery services that refine their deliveries based on which clothes users keep and return. On top of this, brands that tailor-make their products and recommendations based on artificial intelligence algorithms will be able to differentiate their app through deep personalization for users.

The industries and tactics are diverse, but they all create one thing: a personal and social reason to buy in the app, not through Amazon or Alibaba. Similarly, offline big box stores are continuing to be challenged by changing customer buying habits –and like Walmart, may become more acquisitive to survive.

Jet, Walmart’s acquisition to battle Amazon in ecommerce

So … What’s Next?

Even with these advantages, can startups truly outsmart Alibaba and Amazon? The answer is yes, and the reason is the massive amount of growth that remains to be realized in e-commerce.

Amazon and Alibaba may be gobbling up the lion’s share of the two markets, but e-commerce still amounts to just 8% and 16% of the total ~$9 trillion retail market in the U.S. and China respectively. Vast swaths of e-commerce dollars remain to be created and claimed. Projecting forward, the e-commerce market segmentation may end up looking more like traditional retail but with a new twist on shopping as an experience, and likely aided by AR/VR technology and artificial intelligence.

Winning these markets means appealing even more to millennials through their values and their communication channels. As e-commerce markets grow and evolve, the startups that curate, personalize and optimize community have the chance to take home a big piece of this ever-growing pie.