PAYFAZZ wants to build a network of distributed bank agents in Indonesia

Hendra Kwik is hoping to tap into the excitement of on-demand companies like Uber and distributed workforces — except instead of ridesharing, he’s hoping it will work for banking.

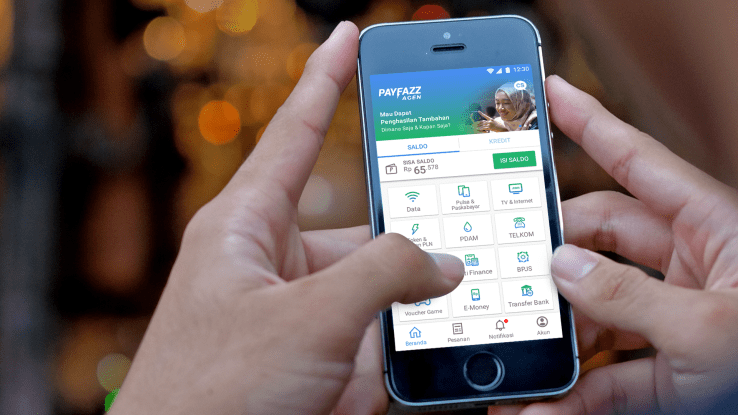

That’s the theory behind PAYFAZZ, which coordinates with banks to create a distributed network of bank agents that can operate from wherever — even their own homes. Once that person is verified and in good standing (based on some background inquiries) they are given a PAYFAZZ balance from a bank and act as an intermediary between a potential customer and the bank. The goal is to build a distributed network of banking touch points much like the bank fronts that you might find all over the place in your city. That kind of network isn’t available in Indonesia and is clustered in major cities instead, Kwik said. The company is coming out of the summer batch of Y Combinator this year.

“Every branch has to serve thousands of people, it’s kind of over capacity,” he said. “The supply of the banks can’t accommodate the burgeoning amount of users. It’s the equivalent of being in the Union Square [in downtown San Francisco], and the people in Mountain View and Oakland would find it difficult to get there [if there were no local bankfronts].”

Prospective users go to those agents and then deposit money. The agent, with a PAYFAZZ balance, transfers part of that balance based on the cash deposit to the new user. That person can then use the balance to pay telecom bills and other various expenses to companies. Having that digital helps break down the barrier to getting people to buy things online, a behavior that isn’t widely adopted in Indonesia, Kwik said.

While I kind of hate the x for y comparisons over here, the analogy isn’t all that awful in this case. Airbnb creates a similar network of “agents” that operate as “hotels” along the lines of these agents operating as banking nodes. And similar to the Airbnb model, the goal is to get those agents paid for their time at the level of around $100 to $200 USD a month (or more, depending on the situation).

When a user pays a bill to a company, PAYFAZZ seeks to work with that company to take a slice of the transaction. The startup hopes to take around 5% of the transaction, and then hand 4 percentage points of that over to the agent. It’s a slim margin, to be sure, but Kwik hopes the company will be able to build up a portfolio of products based on additional spending information it acquires from its users — such as a system for issuing credit.

“We cannot really store the money yet because we’re not a bank,” he said. “But in the future, we’ll probably be a bank on our own. We don’t give interest to the user yet, they store the money now so they can use it. But in [banks like] Citi you get the interest. It’s a payment tool like Square or Venmo. You don’t get it interest, people still use it because it’s way more convenient.”

The major challenge is going to be going up against other efforts to build a digital payment network. The most obvious potential one would be Kudo, which Uber rival Grab in Southeast Asia acquired in February this year. Kwik says PAYFAZZ is targeting the more widely distributed networks — smaller ones that might not actually be that attractive to a larger rival — in order to build up that strong network of agents.