Robinhood rolls out zero-fee crypto trading as it hits 4M users

Coinbase has some serious competition. Today, Robinhood starts rolling out its no-commission cryptocurrency trading feature in California, Massachusetts, Missouri, Montana and New Hampshire. Users there can buy and sell Bitcoin and Ethereum with no extra fees, and everyone can track those and 14 other coins in its sleek app. That’s compared to paying 1.5 to 4 percent fees in the U.S. on Coinbase. Users can sign up on the Robinhood Crypto site to waitlist for access.

Robinhood has a chance to usurp Coinbase as the de facto crypto trading site app by vastly undercutting its fees. When people are buying thousands of dollars of cryptocurrencies at a time, Coinbase’s 1.5 to 4 percent fees in the U.S. can quickly add up.

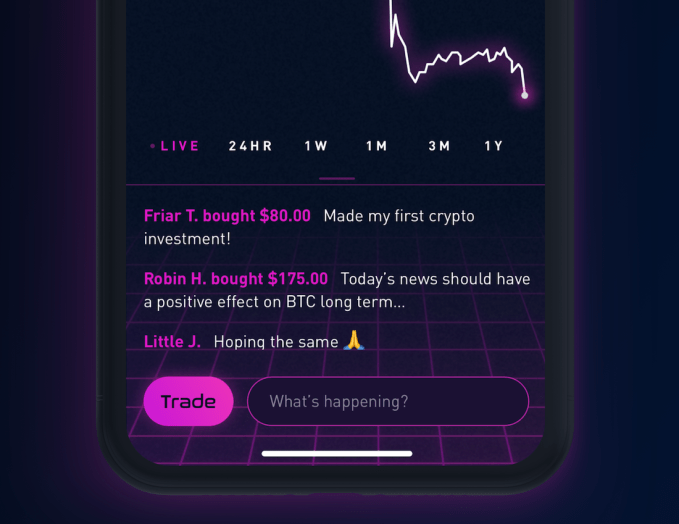

But Robinhood sees giving away the service for free as a powerful play to gain users for its existing service that lets people trade stocks, ETFs and options without additional charges. Its stylish, retro-future Tron interface is also a super easy way to check on pricing and news about 16 coins: Bitcoin, Ethereum, Bitcoin Cash, Litecoin, Ripple, Ethereum Classic, Zcash, Monero, Dash, Stellar, Qtum, Bitcoin Gold, OmiseGo, NEO, Lisk and Dogecoin. Tracking is now available for everyone, with trading coming to waitlisted users and more states soon.

Robinhood Crypto first announced the feature last month, with one million people signing up in just the first four days. That interest has driven Robinhood’s total registered user count to more than 4 million, up from 3 million in November. Those users have transacted more than $100 billion to date, saving $1 billion in commission fees.

On most stock trading services like E*Trade and Scottrade, customers pay around $7 per trade to cover these companies’ marketing, physical branches and sales reps. Founded in 2013, Robinhood ditches those fees by running a lean operation centered around engineers and its app. It makes money on the interest of cash its customers keep with it, or by selling monthly Robinhood Gold subscriptions that let users borrow money to trade with.

That business has allowed the startup to raise $176 million, most recently at a $1.3 billion valuation. And with its free crypto trading, it may have found a way to luring in a fresh class of amateur investors. Keeping security locked tight will be critical, especially given disastrous breaches at other crypto companies. But as crypto draws a new generation into the world of finance, Robinhood wants to help them play the market, day or night.

For more, read our full story on the debut of Robinhood Crypto.

[Disclosure: The author of this story owns small positions in Bitcoin and Ethereum]