These startup exits delivered the biggest bang for the buck

Big IPOs by the best-known brands tend to dominate attention in startup circles. Last year, for instance, it was hard to miss headlines about Snap’s monumental market debut.

But when it comes to delivering significant returns on invested capital, it’s often lower-profile companies that come out on top. Startups like personalized fashion provider Stitch Fix and cancer therapy developer Impact Biomedicines generated multi-billion-dollar valuations after raising a few tens of millions of dollars.

They’re not the only companies that generated a lot of bang for each investor buck. A Crunchbase News analysis of post-exit valuations for the past year’s crop of newly public and acquired later-stage startups showed that quite a few managed to amass valuations totaling impressive multiples of capital raised.

Startups that stood out for their capital efficiency hailed from both tech and life science sectors. We measured them using a valuation to invested capital (VIC) ratio, which is a metric equal to the post-exit valuation divided by the amount of venture and seed funding prior to exit.

Below, we look at some of the top-returning large exits, first for tech and Internet companies, and then for life sciences.1

Tech’s top performers are pretty diverse

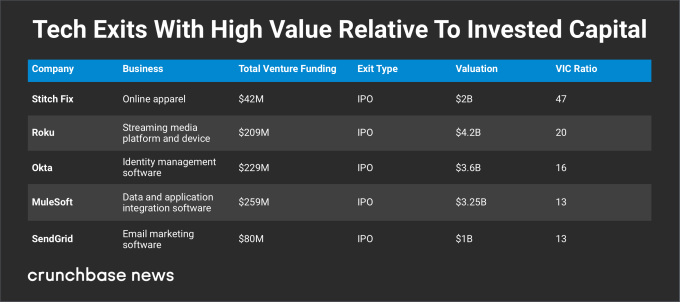

In tech, there’s no single winning sector or strategy for generating a high valuation relative to invested capital. Instead, top performers come from a broad variety of sub-sectors, from fashion ecommerce to streaming media to identity management.

On the fashion front, the aforementioned Stitch Fix stands out as a leader across all tech and internet categories, based on its strong post-IPO performance. Shares of the San Francisco-based company are currently trading up about 50 percent from the October IPO price, with a market cap around $2 billion.

Having raised just $42 million in venture funding before going public, Stitch Fix now has a VIC ratio of a whopping 47. To boot, the seven-year-old company is modestly profitable and seeing growing demand for its service, which matches online customers with personal stylists who select clothes for them.

Stitch Fix isn’t the only consumer-facing company to deliver a big bang for the buck. Roku, the developer of a popular streaming device and platform, has also performed extraordinarily well.

Granted, Roku raised a lot more venture funding. Since its founding in 2001, the Silicon Valley company took in about $209 million in early through late-stage rounds. Investors’ risk-taking appears to have been rewarded following the company’s September IPO, however, with Roku now sustaining a market cap around $4.2 billion. That gives it a VIC ratio of around 20.

In the chart below, we compare the metrics for Stitch Fix, Roku and the three other members of our top-five list:

Life sciences delivers some large returns

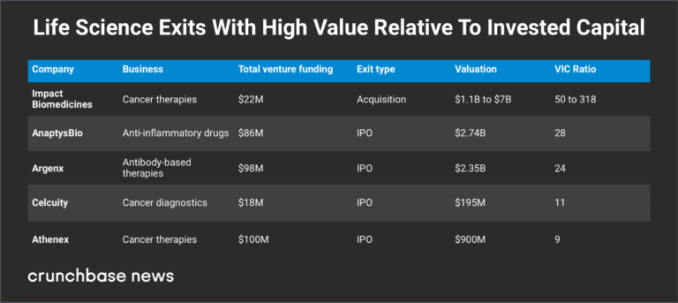

Venture-backed life science companies generally pursue IPOs at a higher rate and earlier stage of development than their tech counterparts. That’s in part because public markets are a popular source of financing for clinical trials, and investors have historically been willing to buy shares of pre-revenue companies in the space.

This past year, with major stock indexes on a tear, going public proved a particularly lucrative strategy for several VC-funded biotechs, which saw shares rise dramatically post-IPO. Big acquisitions were less common but still delivered some large outcomes, including our top-returning company across all sectors: Impact Biomedicines.

Four of the five top performers in our life sciences list are working on therapies or diagnostics for cancer patients, and Impact is no exception. The company, which spun out of drug developer Sanofi a little over a year ago with a promising blood cancer treatment, sold to Celgene earlier this month for $1.1 billion upfront and up to $5.9 billion in milestone-based payments. That gives Impact a VIC ratio of at least 50 and as high as 318.

Second on our list is AnaptysBio, which has seen its shares soar more than 600 percent following its market debut in January 2017. The San Diego company has clinical-stage drugs to treat ailments including severe adult peanut allergy and asthma.

In the chart below, we compare the metrics for Impact, AnaptysBio and the three other members of our top-five list:

The case for capital efficiency

It’s worth noting that the VIC ratio is not a measure of investor returns, as it does not specify the size stake in a startup that backers obtained in return for their investment. Companies that relied on bootstrapping for much of their early development, for instance, may post high multiples without delivering commensurate returns to investors, who likely bought in at higher entry-level valuations. Ditto for startups that spun out of corporate parents with relatively mature technologies.

That said, capital efficiency does matter as a yardstick for the startup value creation. We see plenty of companies that raised copious sums of financing go on to be worth less than invested capital. One prominent 2017 example was storage technology provider Tintri, which raised about $245 million in private funding rounds before going public in June. It’s now valued at less than $200 million.

More commonly, however, companies that do go public are worth more than what they raised privately. Even newly public companies that traded below prior private valuations, like Cloudera and Blue Apron, are still worth several times invested capital.

But in a startup environment where investors continue to chase unicorns and mega-rounds, it’s worth noting that the largest returns don’t always go to the most predictable candidates.

- For this article, we limited the data set to IPO valuations and reported acquisition prices in excess of $500 million.

Featured Image: Rrraum/Shutterstock