Goldman is reportedly getting into bitcoin and crypto trading

Global banking giant Goldman is setting up up a trading desk focused on bitcoin and other cryptocurrencies, according to a report from Bloomberg.

The bank is said to be in the early stages of setup, which means hiring and figuring out the logistics, including how the bank will hold the assets and keep them secure. The ultimate goal, Bloomberg claimed, is to begin trading by June 2018.

“In response to client interest in digital currencies, we are exploring how best to serve them,” the bank told Bloomberg in a statement.

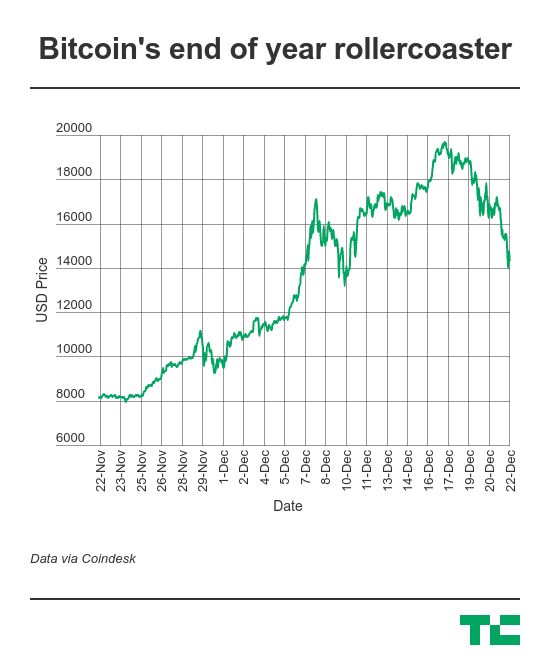

The move would make it the first major bank to embrace trading bitcoin and cryptocoins, which have surged in value in 2017, with bitcoin itself getting close to the $20,000 mark before falling this week. It’s current price is $14,633, according to Coindesk, a huge jump on $998 on January 1 2017.

Goldman is one of a handful of financial organizations to offer Bitcoin Futures for selected clients. CBOE was first to offer the trading option on December 10, and it has since been joined by CME. There has been opposition from some banks who expressed concern at a lack of transparency and regulation around Bitcoin Futures.

The involvement of financial institutions has coincided with a bumpy ride for bitcoin owners, with price moving close to $20,000 in the past week only to dip below $15,000.

As TechCrunch’s own John Biggs said earlier this month, factors that are driving the market and pricing are unclear and unpredictable.

“No one can currently predict what bitcoin and other cryptocurrencies will do for us in the future. Until we know, it’s best to buckle up and enjoy the ride,” Biggs wrote.

Note: The author owns a small amount of cryptocurrency. Enough to gain an understanding, not enough to change a life.

Featured Image: Bryce Durbin/TechCrunch