Superangel is a new pre-seed and seed fund out of Estonia with company builder ambitions

A new micro VC fund backed by a host of well-known names in the Estonia tech scene is de-cloaking this week. Dubbed “Superangel“, the new fund is targeting a final closing of €20 million but has already raised €12 million. It will make pre-seed and seed investments of between €50,000 and €250,000 on average per company, up to €2 million including follow-on investments.

I’m also told the VC — which is based in Tallinn, Estonia and Palo Alto, California — plans to invest in startups globally, but will give particular priority to European startups that are aiming for a global market, and U.S.-based startups that are looking to penetrate European and emerging markets.

Beyond that, the Superangel fund will be sector agnostic, sticking to a broad remit of information technology. However, when pushed, fintech, mobile, SaaS, sharing economy, blockchain, and AR/VR were singled out as sectors the micro VC is keeping a close eye on.

“We’re early investors, so we mostly look at the founding team,” Superangel Managing Partner Rain Rannu tells me. “We invest in great founders, who have clear vision, relentless determination, and who are good at getting things done. They might not have nailed down the product idea or business model yet, but if they’re kickass founders, they have a good chance to figure it out eventually”.

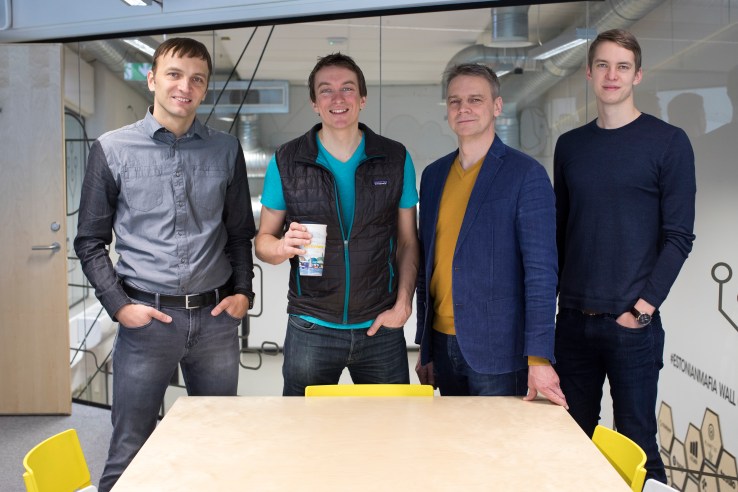

To that end, the fund’s backers include Taxify founders Markus and Martin Villig, former general manager of Skype Sten Tamkivi, founder of PlanetOS Rainer Sternfeld, along with other unnamed entrepreneurs. Rannu previously co-founded mobile payments company Fortumo with another of Superangel’s Managing Partners, Veljo Otsason. Investment Manager Marko Oolo was an early employee of TransferWise. The firm’s other Managing Partner is Marek Kiisa, a Kauffman Fellow who was the first investor in GrabCAD and Bikeep.

“Additionally, we have a Company Builder program where we invest up to €100,000 per team already in the idea formation phase,” adds Rannu. “We invite great founders without a clear product idea yet to join us as Founders in Residence. Then we will work closely together to develop the idea and form a team, leveraging our partners and investors network and experience until they find product-market fit and “graduate” to attract outside funding. I think this is quite different from most funds”.