A peek inside Alphabet’s investing universe

Chances are high you have heard of Google. You are likely a contributor to one of the 3.5 billion search queries the website processes daily. But unless you’re a venture capitalist, an entrepreneur or a slightly obsessive technology journalist, you may not know that Google — or, more properly, Alphabet, the corporate parent to the search and internet ad giant — is also in the business of investing in startups. And, like most of what Google does, Alphabet invests at scale.

Today we’re going to undertake, if you will forgive the pun, a search of Google’s venture investments, its portfolio’s performance and what the company’s investing activity may say about its plans going forward.

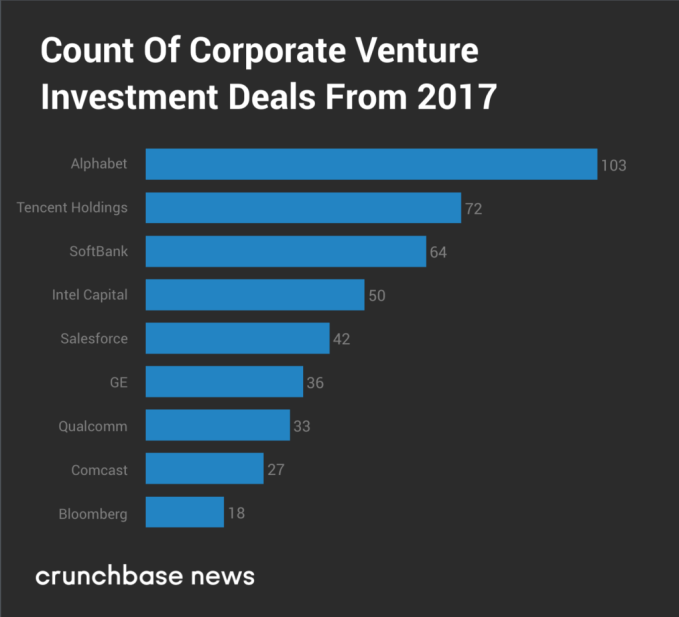

Alphabet was the most active corporate investor in 2017

Taken together, Alphabet is one of the most prolific corporate investors in startups. In 2017, Crunchbase data shows that Alphabet’s three main investing arms — GV (formerly known as Google Ventures), CapitalG and Gradient Ventures — and Google itself invested in 103 deals.

(Crunchbase News contacted Alphabet for this story but did not hear back in time for publication.)

Below, you’ll find a chart comparing Alphabet’s investment activity to other major corporate investors, based on publicly disclosed deals captured in Crunchbase data.

For years, Intel and its venture arm Intel Capital topped the ranks of most active corporate venture investors. But for 2017, Crunchbase data suggests that Alphabet’s primary venture funds unseat the chip manufacturer. With 72 deals struck, Tencent Holdings and its venture affiliates rank second and SoftBank, which has a $100 billion pool of capital to slosh around, comes in third with 64 deals announced in 2017.

The Alphabet investing universe

As we alluded to earlier, Alphabet has a somewhat unusual setup for a corporate investor. Data shows that Alphabet makes the overwhelming majority of its equity investments out of four primary entities:

- GV, formerly known as Google Ventures, is Alphabet’s most prolific venture fund.

- Growth equity fund CapitalG invests primarily in late-stage deals.

- Gradient Ventures, Google’s newest fund, is focused on artificial intelligence deals.

- Finally, Google itself, has made a number of direct corporate venture investments.

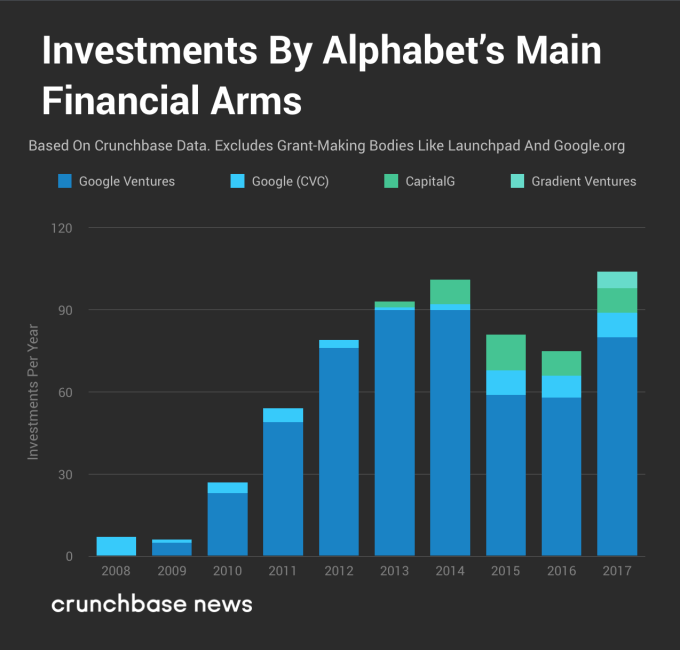

Alphabet and its funds upped their pace of investing too, as the chart below shows:

In 2017, Alphabet’s equity investment deal volume topped historical highs from 2014.

In addition to these equity investment operations, Google operates the Launchpad Accelerator, which grants $50,000 equity-free to startups in Africa, Asia, South America and Eastern Europe. The company also issues grants and makes impact-oriented investments out of an entity called Google.org.

Taken together, here is what the Alphabet investment universe looks like:

The network visualization above shows the connections between Alphabet’s various investing groups and their respective portfolios.1 This graphic depicts 676 connections between six Google investing groups (labeled above in yellow), 570 portfolio organizations and 75 companies that acquired Alphabet-backed portfolio companies.

And, for the most part, there isn’t as much overlap as one may expect. CapitalG and GV only share two portfolio companies. GV invested in the seed round of Gusto, the payroll and HR software platform, and both GV and CapitalG invested in Gusto’s Series B round. GV and CapitalG also invested in Pindrop’s Series C round, although CapitalG led that round. Apart from those two companies, though, Crunchbase data doesn’t suggest any other portfolio overlap between GV and CapitalG.

Google and GV also share some portfolio companies. Google led INVIDI Technologies’ Series D round, in which GV was a mere participant. Google also led the Series A round of popular consumer genetics company 23andMe. Google followed on in the Series B round, in which Google co-founder Sergey Brin was also an investor. GV didn’t invest in 23andMe until its Series C. GV continued its investment all the way through 23andMe’s Series E. Google and GV are also investors in Ripcord, an early-stage company building robots that scan and digitize paper documents.

Shared exits

If there isn’t much overlap between Alphabet’s assorted funds and their investing activity, where is it then? The answer, it seems, may be in the exit data.

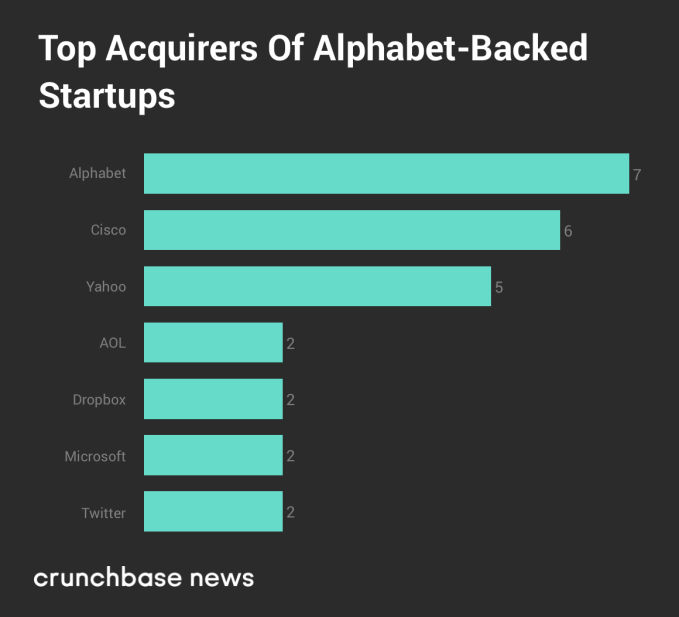

A wide range of companies have acquired startups in which one or more of Alphabet’s capital deployment arms invested. Crunchbase data shows that 81 entities have acquired 100 companies in which Google invested. Of those, it seems like Alphabet is its own best customer, as the chart below shows:

All in, Alphabet has acquired seven companies in which it had previously invested. Google itself acquired six companies it previously invested in, and its X unit (formerly known as Google X) acquired Makani Power, a company that developed airborne wind turbines, in which Google had directly invested. Other frequent trading partners with Google are Cisco, which has acquired six Google-backed companies, and Yahoo (now, together with AOL, part of Verizon-controlled Oath) with five acquisitions.

As an aside, Google invested in both SolarCity and Tesla, two companies with ties to Elon Musk. In 2011, Google invested $280 million in SolarCity, a company founded by two cousins of Musk. Google and its co-founders Larry Page and Sergey Brin invested in Tesla’s Series C round alongside Musk, Tesla’s co-founder. Tesla went public in 2010 and completed its acquisition of SolarCity, a $2.6 billion all-stock deal, in 2016.

And as the network visualization above shows, Tesla isn’t the only Alphabet portfolio company to go public. Alphabet funds struck venture deals with 11 other companies that have since gone public, including Baidu, HubSpot, Cloudera, Spero Therapeutics, Lending Club and Zynga.

Deals spanning A to Z

If one had to describe Alphabet funds’ collective portfolio of venture deals in one word, it would be “eclectic.” Unlike many corporate venture portfolios, there doesn’t appear to be a unifying, cohesive theme to Alphabet’s outside investments. The AI-focus of Gradient Ventures aside, Alphabet is just as likely to invest in a homeowners insurance company like Lemonade or a customer support platform like UJET (which Crunchbase News covered recently) as it is to invest in non-dairy milk producer Ripple Foods or African tech recruiting platform Andela.

The diversity of Alphabet’s venture investments echoes the diverse collection of businesses, initiatives and long-shot bets under its corporate umbrella. And just like it’s difficult to predict what kind of new project Alphabet will launch next, it seems that no amount of searching and sifting can say what its venture arms will embrace next.

- The network visualization was created using Gephi, an open-source software package used for making network visualizations, and the ForceAtlas2 layout algorithm.

Featured Image: Li-Anne Dias