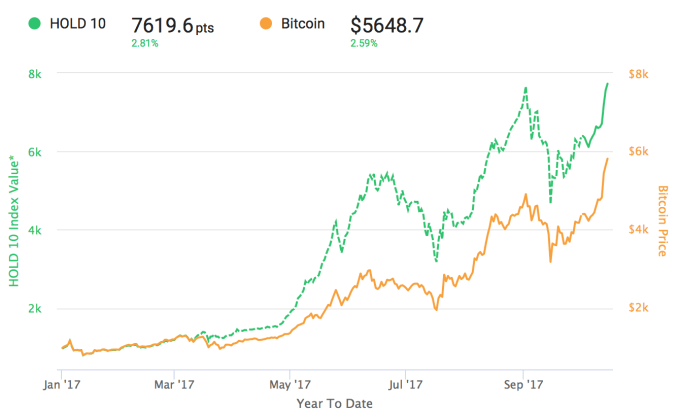

The HOLD 10 Index is a passively managed fund of the top 10 cryptocurrencies

This year the market capitalization of all cryptocurrencies has grown from about $13 billion to well over $150 billion, fueled by infusions of capital from all different types of investors. But regardless of this extreme growth, it’s still very complicated for most people to invest in cryptocurrency. So one startup is launching a private index fund designed to let you passively hold a stake in the 10 largest cryptocurrencies, weighted by market cap.

Called the HOLD 10 Index, the fund is designed to passively hold the top 10 cryptocurrencies by market cap (including a 5 year inflation schedule). The funds are 100% cold storage secured except for when the portfolio is rebalanced once a month to account for fluctuations in pricing among the basket of assets.

Right now the assets included are: BTC, ETH, XRP, BCH, LTC, DASH, NEO, ZEC, XMR (Monero) and ETC.

You can read a bit more about inclusion criteria here, but there are a few more requirements besides being in the top 10 – these include things like free-floating price, trade volume requirements and being traded on sufficient exchanges. This additional requirements exclude currencies like NEM, which doesn’t meet a 30% of supply traded per month for the last 3 months requirement that the index has.

While investors have to be U.S-based and accredited since it’s a private vehicle and not an ETF, the minimum is only $10,000 – which as you can see below is much less than any current alternatives.

HOLD 10 Index vs Bitcoin over the last year

Founded by Hunter Horsley and Hong Kim, the startup behind the index is called Bitwise Investments – and eventually wants to become something like the Vanguard of cryptocurrency. For this first index fund there’s no performance fee and only a 2-3% annual management fee, which for most investors will be well worth it considering the alternatives. Naval Ravikant of AngelList and Elad Gil are both investors in the new company.

Speaking of which, to understand the benefit that this fund could provide investors, it’s important to understand the current methods available to investors wanting to put their money into cryptocurrency.

First, they could do it the old fashion way and purchase cryptocurrency on exchanges and then hold the private keys. This is pretty technically complicated for an average investor, and while you have 100% control of your funds it means you now have the extra burden of keeping safe (but still remembering) your private keys, as well as knowing how to send and receive funds when you want to rebalance or cash out.

Next, they could use a service like Coinbase or Gemini to purchase cryptocurrency and hold them online. These sites do typically hold your funds in “cold storage” to reduce the risk that they will be stolen, but at the end of the day there’s still always a risk of something happening to your money when you’re not in total control. That being said, it’s still relatively safe and a lot easier than managing your own private keys. One big downside though – you’re going to be limited to only investing in the two or three largest crypocurrencies, since these big exchanges and wallets only support bitcoin, ethereum and sometimes litecoin.

Your last real option is to let a private cryptocurrency hedge fund (of which there is no shortage) handle the entire process for you – but these often have very high investment minimums (in the millions) and very high fees. So this option is off the table for average investors.

There’s no doubt that a decade from now investors will have endless options to easily and safely invest in cryptocurrency and crypto assets. But as you can see above, that isn’t the case just yet – which is why this new fund is so interesting.