Cap table apps team up as Solium acquires Capshare

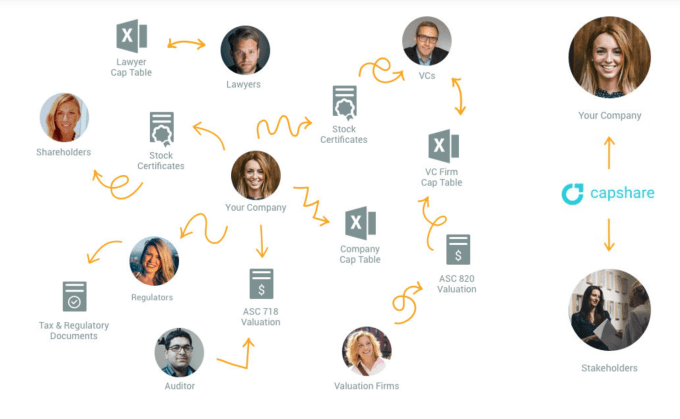

Uber, SpaceX and Stripe rely on Solium to keep track of all their shareholders and stock plans; 10,000 smaller startups turn to Capshare for more streamlined equity software that’s not clumsy like spreadsheets. Now Solium is buying out Capshare and letting it run independently, so together they can handle shareholder management from inception to IPO.

Terms of public company Solium’s acquisition of $3 million-funded startup Capshare weren’t disclosed. But after earning $80 million in revenue last year, Solium needed to protect its business from the shift toward startups staying private for longer.

A source close to the now-combined companies tells me the Capshare team is heavily incentivized to stick around and grow the business, and it received a premium on its asking price as there were multiple acquirers at the table. Capshare hit profitability in May, so it didn’t need to sell, but having a big public Solium was too good to pass up.

“Solium will bring a great foundation to Capshare as we continue our growth trajectory. It will also give us the ability to better serve our customers by focusing on the needs of early-stage companies,” says Capshare CEO Jeron Paul. “As our growing customers have requirements that become more complex we can transition them to Shareworks.”

“Moving an enterprise platform, like Shareworks, down market is an extremely tough thing to do,” Solium CEO Marcos Lopez tells TechCrunch. “By bringing Capshare into the fold we can focus on making Shareworks an even better product for later-stage and pre-IPO companies while Capshare can optimize for earlier stage companies.”

Solium could use the wide breadth of its services to recruit startups when they’re small with the promise of minimizing the hassle of scaling up their equity management software as they grow larger and more complicated. That could give it an edge against other solutions like Gust, Capyx and eShares.

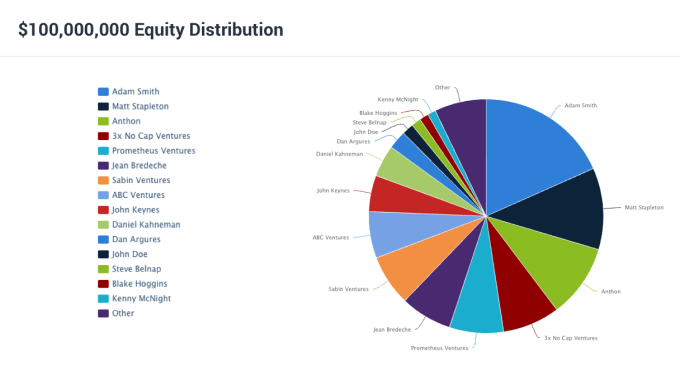

“We serve 6 of the 10 largest private companies, and some of these larger ‘unicorns’ today have stock option plans and cap tables that are as sophisticated as a public company,” Lopez says. And with equity and dilution becoming top concerns for sought-after talent, companies benefit if they can show employees their path to riches.

With better cap table management, startups get a clearer view of the downstream impacts of new funding rounds. Raise at too high of a valuation, and it could be tough to hit milestones and raise more later. Try to keep all the equity for the founders, and better capitalized competitors can steal the market. But if you know who owns what and how that will change, startups can raise as little as they can and as much as they need.