Facebook drops no-vote stock plan, Zuck will sell shares to fund philanthropy

Mark Zuckerberg has gotten so rich that he can fund his philanthropic foundation and retain voting control without Facebook having to issue a proposed non-voting class of stock that faced shareholder resistance. Today Facebook announced that it’s withdrawn its plan to issue Class C no-vote stock and has resolved the shareholder lawsuit seeking to block the corporate governance overhaul.

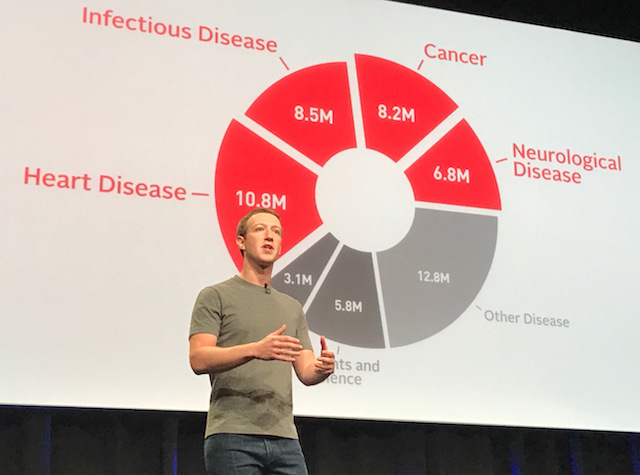

Instead, Zuckerberg says that because Facebook has become so valuable, he can sell a smaller allotment of his stake in the company to deliver plenty of capital to his Chan Zuckerberg Initiative foundation that aims to help eradicate disease and deliver personalized education to all children.

“Over the past year and a half, Facebook’s business has performed well and the value of our stock has grown to the point that I can fully fund our philanthropy and retain voting control of Facebook for 20 years or more,” Zuckerberg writes. Facebook’s share price has increased roughly 45 percent, from $117 to $170, since the Class C stock plan was announced, with Facebook now valued at $495 billion.

Mark Zuckerberg, Priscilla Chan and their daughters Max and August

“We are gratified that Facebook and Mr. Zuckerberg have agreed not to proceed with the reclassification we were challenging,” writes Lee Rudy, the partner at Kessler Topaz Meltzer & Check LLP that was representing the plaintiffs in the lawsuit seeking to block the no-vote share creation. Zuckerberg was slated to testify in the suit later this month, but now won’t have to. “This result is a full victory for Facebook’s stockholders, and achieved everything we could have hoped to obtain by winning a permanent injunction at trial.”

“I want to be clear: this doesn’t change Priscilla and my plans to give away 99% of our Facebook shares during our lives. In fact, we now plan to accelerate our work and sell more of those shares sooner,” Zuckerberg wrote. “I anticipate selling 35-75 million Facebook shares in the next 18 months to fund our work in education, science, and advocacy.” That equates to $5.95 billion to $12.75 billion worth of Facebook shares Zuckerberg will liquidate.

When Zuckerberg announced the plan in April 2016, he wrote that being a founder-led company where he controls enough votes to always steer Facebook’s direction rather than cowing to public shareholders lets Facebook “resist the short term pressures that often hurt companies.” By issuing the non-voting shares, “I’ll be able to keep founder control of Facebook so we can continue to build for the long term, and Priscilla and I will be able to give our money to fund important work sooner.”

A spokesperson for the Chan Zuckerberg Initiative told TechCrunch that this outcome is very good for the foundation, because it provides more predictability to its funding. The plan will also allow Zuckerberg to deliver cash to the CZI sooner, which its new CFO Peggy Alford will be able to allocate between its health, education and advocacy projects.

With the new plan to sell shares, it’s unclear what might happen to Zuckerberg’s iron grip on Facebook’s future in “20 years or more.”

Dropping the Class C shares plan may be seen as a blow to Facebook board member Marc Andreessen, who Bloomberg revealed had coached Zuckerberg through pushing the proposed plan through the rest of the board. But given Zuckerberg’s power, Andreessen is unlikely to be ousted unless the Facebook CEO wants him gone.

Zuckerberg strolls through the developer conference of Oculus, the VR company he pushed Facebook to acquire

For the foreseeable future, though, Zuckerberg will have the power to shape Facebook’s decisions. His business instincts have proven wise over the years. Acquisitions he orchestrated that seemed pricey at first — like Instagram and WhatsApp — have been validated as their apps grow to multiples of their pre-buy size. And Zuckerberg’s relentless prioritization of the user experience over that of advertisers and outside developers has kept the Facebook community deeply engaged instead of pushed away with spam.

Zuckerberg’s ability to maintain power could allow him to continue to make bold or counter-intuitive decisions without shareholder interference. But the concentration of power also puts Facebook in a precarious position if Zuckerberg were to be tarnished by scandal or suddenly unable to continue his duties as CEO.

Zuckerberg warned investors when Facebook went public that “Facebook was not originally created to be a company. It was built to accomplish a social mission.” And yet Facebook has flourished into one of the world’s most successful businesses in part because shareholders weren’t allowed to sell its ambitions short.