Tax on Internet ads among Europe’s proposals to plug digital tax gap

Europe’s executive body has revealed more of its thinking on reforming taxation rules to reflect how digital businesses operate, issuing details of proposals it’s considering ahead of another meeting of EU ministers next week.

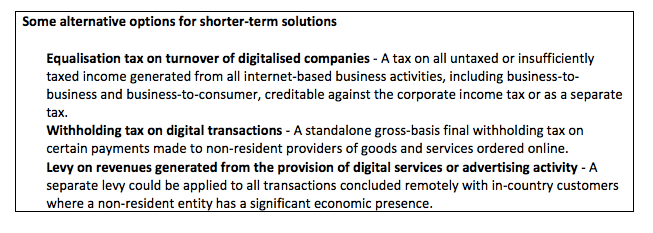

Options on the table for EU countries to discuss are a turnover tax, a levy on Internet ads or withholding money on Internet transactions, the EC said today.

Last week a group of European Union finance ministers, led by France, called for a turnover tax on tech giants — aka what’s also referred to as an “equalization tax” — which would seek to avoid the problem of multinationals shifting profits to lower tax economies by taxing them on the revenue generated in each nation.

At the time the EC said it welcomed the Member State’s interest in the issue, noting it has been working towards tax reform proposals for “a number of years”.

Today it said it wants to see if it can tackle tax base erosion and profit shifting in the short term by focusing on tech firms — while it continues to try to advance a longer term tax reform agenda based on adjusting a proposed Common Consolidated Corporate Tax Base (CCCTB) system to allow for virtual establishment (to get around the issue of digital services being able to cross borders without a company necessarily having to have a permanent bricks-and-mortar presence in a country).

International-level discussions on tax reform have been ongoing for several years, involving the EC and other bodies such as the OECD, the WTO and the G20.

At a press conference today, EC VP Valdis Dombrovskis said: “At EU level, the [CCCTB] proposal offers a basis to address key challenges, for example by further adjusting permanent establishment rules. We propose to examine enhancements to these rules to ensure that they effectively capture digital activities.

“However, this may take time, given its complexity. And the digital economy will not stop growing in the meantime. Therefore, we will also look at other short-term options to tackle specific tax challenges.”

He indicated that the EC is prepared to go ahead on reforming tax rules to adapt to the increasing digitization of economic activity without waiting for a wider international consensus — even as he reiterated the Commission’s view that the ideal solution would be a global one.

“Of course, we are aware that a global answer is the best. This is why the EU is already working with the OECD and the G20 on these issues. What counts now is that the EU speaks with one voice in the international arena, and we will work to arrive at a common EU position on this issue by December,” he said.

“However the EU must also be prepared to act in the absence of adequate global progress. In the coming months, we will, together with the Member States, carefully analyze the different options. The next immediate step is the Digital Summit in Tallinn next week.”

He noted that some EU Member States have already taken unilateral action to try to claw in more tax from digital giants like Google. The UK is one (current) EU member that has, in recent years, changed its tax rules to crack down on multinational companies that are seeking to shift profits generated in the country to overseas territories. (It brought in this so-called ‘Google tax‘ targeting tax evasion in 2015.)

Under the EU’s rules Member States retain powers to set their own taxation policies. And Dombrovskis said the EC’s concern is that’s leading to a patchwork of tax regimes across the bloc as states respond to the challenge of the increasing digitization of the economy — which he argued could undermine a major strategy it’s been pushing to harmonize digital business by creating an EU ‘Digital Single Market’.

Tax is a trickier issue, though, as some EU countries such as Ireland have set lower corporate tax rates in a deliberate effort to encourage digital giants to make a European base on their soil.

At the press conference today journalists pressed Dombrovskis on the likelihood of these lower tax EU Member States agreeing to digital tax reforms that would directly attack their economic model.

The EC VP had no clear answer on that. Instead he emphasized that talks are only at a discussion stage between EU states at this stage, and that the aim is to try to reach consensus — though he did also suggest the EC might be prepared to consider a majority opinion to make changes to the tax rules — “if we can’t get uniformity”.

“The Commission’s preferred solution is certainly that there is a unified EU response to this challenge so it’s important that EU reach a consensus on the way forward before we start exploring other avenues like enhanced co-operation,” he said.

One looming issue that may well be concentrating the minds of EU lawmakers to expedite digital tax reform is Brexit, as the UK government has indicated it could lower its own corporate tax rates after it leaves the bloc in May 2019. The UK also announced a review of its corporate tax rate last November.

So — for example — a turnover tax on digital companies could be one way for the EU as a region to bolster itself against the risk of the UK accelerating the problem of profit shifting if it ends up seeking to operate a low tax regime right off the EU’s shore. Though Dombrovskis also played down Brexit as a factor, saying discussions on tax reform long predate the UK’s vote to leave.

He said the EC is hoping to have a proposal on digital tax reform agreed by Spring 2018 — which could then be put to the EU’s other institutions, the EU Parliament and Council, which would also need to approve it before any rule changes could be implemented across the bloc.

So there’s plenty of hurdles still stacked in front of any reform.

And the EC’s wider strategic hope could be to inspire speedier action on tax reform at the international level — which would avoid the risk of the region being disadvantaged on the world stage by taking a lead on imposing new digital tax rules while other regions are still considering their options.

“What we are seeing is we are seeing a real challenge and we think we need to respond to this challenge. And as I said we see the best answer is global answer, that’s why we engage with OECD. But of course if we see there is no sufficient progress at global level then we act at European level,” added Dombrovskis.

“I think at the end of the day it’s also in the interests of Member States to protect their tax bases and to avoid fragmentation of internal market when different Member States enforce their unilateral responses. And I hope that we’ll be able to reach agreement on this, also be able to reach agreement on common position which we can represent at the global stage to address this very real problem.”

Featured Image: ilbusca/iStock