SoftBank, Dragoneer, Didi close to finalizing investment in Uber

Japan’s SoftBank Group, U.S. investment group Dragoneer and Chinese rideshare giant Didi Chuxing are close to finalizing their investment in Uber via a joint venture, sources tell TechCrunch. The tender offer is on track to launch by the end of the month and includes a direct investment in the company, as well as the purchase of shares from employees and early investors.

The potential investors were first reported by The New York Times about a month ago. We’re hearing that the conversations are not only still happening, but that the deal is likely to include the largest secondary transaction in history, with thousands of Uber employees eligible to sell shares.

Bloomberg earlier reported that Uber could be lining up between $2 billion and $10 billion from these new investors. We’re hearing that the latest conversations involve numbers toward the top of that range, around $8 billion to $10 billion.

The investment is being led by Dragoneer, Didi and SoftBank — which now has about $100 billion to deploy from its Vision Fund — but General Atlantic is also expected to participate. A special-purpose vehicle is being formed to make the investment.

Uber declined to comment.

The round is significant, not only because of the deal size, but because the shares will likely be purchased at Uber’s last private valuation of nearly $70 billion. After months of public scrutiny and a formal investigation into the company’s culture, which led to many executive departures, including CEO Travis Kalanick, there has been widespread speculation that Uber’s valuation would be cut. Instead, this move doubles down on its existing value.

It also gives employees and early investors another opportunity to cash out. For years, Uber restricted the sale of equity stakes, making it difficult for these individuals to turn this compensation into cash.

After its policy came under fire, the company began conducting buybacks earlier this year. We’re told that Uber just finished a second buyback last week that was made available to hundreds of employees who were eligible to sell up to 20 percent of their stake in the company.

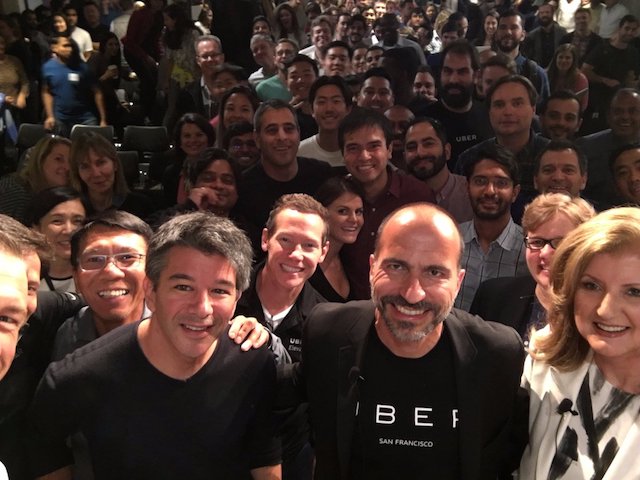

Such moves also reduce some of the pressure for Uber to orchestrate a liquidity event. New CEO Dara Khosrowshahi recently told Uber employees than an IPO is still 18 to 36 months out.

Equity investors who have invested about $9 billion in the company since 2010 are likely also highly supportive of a funding deal that allows them to turn some of their paper gains into riches.