Why ‘TAM’ doesn’t matter to me

When you ask a VC what they look for in investments, you’re likely to get a response that involves going after a large “TAM,” or “total addressable market.” TAM is defined as “the existing revenue opportunity available for a product or service,” and it’s often calculated by taking the existing top-down market size and whittling down segments of the market that are not addressable.

On the surface, the use of TAM as a key investment criteria makes perfect sense. To build a business that goes from very little to very large in a short amount of time, you must attack a very large market, right?

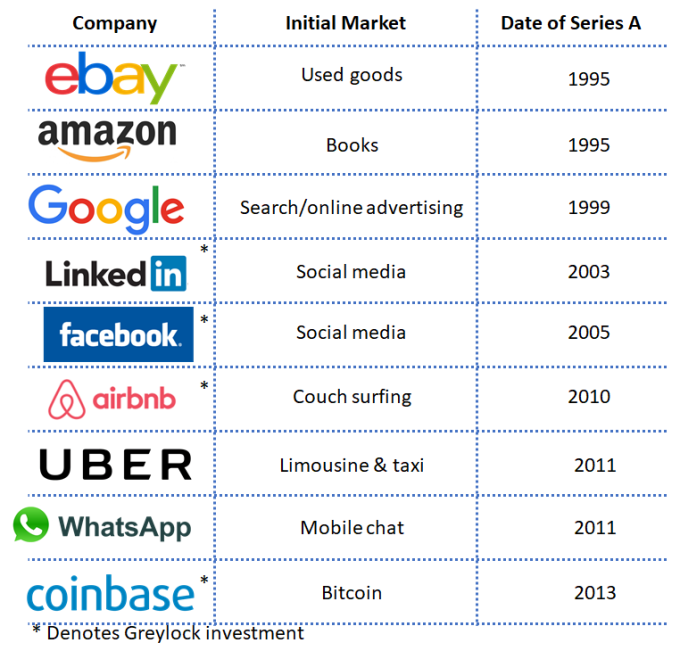

The only problem is that if you had applied the TAM framework over the past 25 years, you would have passed on most of the best venture investments of all time. A cursory examination of these companies in their early years highlights the danger of too heavily weighting TAM. In fact, at the time of their Series A rounds, many of the very best venture investments would have had relatively small — or even undefined — TAMs.

Let’s examine Uber. At the time the Series A was done in 2011, Uber’s product was a substitute for premium car services like black cars and limousines, not a taxi substitute. At that time, the total U.S. car service market was $2 billion in annual revenue, which would yield a $400 million TAM assuming a 20 percent take rate for Uber.

Later on, Uber launched Uber X, a lower-cost alternative that made it a true taxi substitute and made its global ambitions more apparent. But even in 2014, if you had considered the broadly defined global taxi and car service market of ~$100 billion, the $20 billion TAM would have still understated the magnitude of Uber’s opportunity. In fact, one famous economist did just this when he concluded that Uber could not possibly be worth $17 billion due to the TAM of the taxi and car service markets.

WhatsApp is another example. At the time of the Series A in early 2011, there were ~500 million people with smartphones worldwide. Facebook, which eventually bought WhatsApp, was earning $6 per user annually. So an optimistic estimate for WhatsApp’s TAM would have been $3 billion. For what it’s worth, WhatsApp is still essentially pre-monetization six years later, but it has 1.2 billion users and clearly Facebook saw much greater potential in the platform when it paid $19 billion to acquire it in 2014.

Coinbase is a more recent example (Disclosure: I am involved as an investor). When the Series A was done in May 2013, the total market cap of Bitcoin was ~$1 billion and the daily trading volume was <$5 million. Assuming a 2 percent commission rate, the annual TAM for Coinbase would have been $36.5 million. Hardly the type of TAM that venture capitalists seek. Today, there is a >$100 billion market cap for crypto-currencies, and daily trading volume often surpasses $4 billion. Needless to say, when I wrote Greylock’s investment memo for Coinbase, I did not use the term TAM.

If TAM can be directionally misleading in the early years, how should founders and investors think about weighing the importance of market size? Of course, the eventual size of the market opportunity is paramount. There are several other factors to consider — in addition to the strict measurement of TAM — when trying to assess size of market opportunity:

-

- TAM expansion: The best companies always fundamentally change the markets in which they operate. They do this in many ways: removing friction, increasing convenience, enabling new use cases and lowering price. By doing so, they can dramatically expand the size of their markets. Airbnb, in which Greylock is an investor, did this to the short-term rental market by smoothing the trust barrier associated with renting out your home or staying in someone else’s. In doing so, they expanded the TAM of short-term rental.

- Credible adjacencies: In other cases, a startup’s initial product or service is merely an entry wedge into a larger opportunity. For instance, Amazon started with selling books because the category had a large number of SKUs, shipped well and had near universal appeal. In retrospect, books were just the entry wedge in to selling everything online. The art here is understanding when proposed adjacencies are real and when they are fiction.

- Nascent market potential: Successful startups often ride the wave of a new market that is small today, but will be big in the future, with or without that startup. WhatsApp with the smartphone revolution and Coinbase with crypto-currency are two examples. In many technology businesses, there is a tremendous advantage of being the first to scale in an emerging category. Starting or investing in the early player in a developing category can be a great bet.

- Frequency of use: As a general rule in consumer technology, the frequency with which users interact with a given product or service tends to correlate with the size of the opportunity. Something that becomes a regular behavior with a large swath of the population generally has an opportunity to build a big business. Ofo and Mobike, the Chinese bike-sharing companies, are early examples of this phenomenon. The bike-sharing TAM is still relatively small, and they only collect cents for each ride, but investors see opportunity in something that people use 2-3x per day for the critical task of commuting.

By all means, founders and investors should continue to think about the size of the market they serve. Doing so helps prioritize development, understand customer segmentation and uncover non-obvious insights. But take it with a grain of salt; and if you see an opportunity, don’t let a TAM number stop you from building something great.

Featured Image: snapgalleria/Shutterstock