Cloud data management startup Druva raises $80M

There is an ongoing trend among businesses to put more of their data into the cloud — and as part of that, to bring ever more smartphones, tablets, laptops and other devices on to their networks to create and consume that data. That is driving a lot of traffic to startups building smart ways to capture, back up and analyse these increasingly complex network architectures. Today, one of the bigger of these startups is announcing a large round of funding.

Druva — which has built a platform that provides backup and data protection for some 4,000 business networks’ various endpoints, infrastructure and apps as of today — has raised $80 million to double down on providing data management and protection for companies that have built networks that use public cloud platforms, going head to head with the likes of EMC, Commvault and Veritas, as well as other data management startups like Rubrik.

“The secondary storage space is ripe for disruption based on the convergence of workloads and the adoption of cloud,” co-founder and CEO Jaspreet Singh told TechCrunch.

This latest round brings the total raised by Druva close to $200 million. It was led by Riverwood Capital (a VC that specialises in growth rounds), and also included participation from previous backers Sequoia Capital India, Nexus Venture Partners, Tenaya Capital, “and most other existing venture investors.”

While Singh would not disclose Druva’s valuation, he did describe this funding as “opportunistic” and the company’s valuation as “a significant up round as the combination of our execution and market opportunity have enhanced our market value significantly.”

As a point of comparison, one of its competitors Rubrik is now valued at $1.3 billion after raising $180 million earlier this year. And Druva’s valuation was last estimated to be around $637.5 million at its last round ($51 million in 2016), and the company tells me it has grown over 300 percent in the last year, with some of its customers including Continental, Emerson, Flex and Fujitsu.

One observer has described the company as on track to be the first SaaS “unicorn” (that is, valued at $1 billion or more) to come out of India, as Druva was originally founded in Pune before relocating to sunny Sunnyvale.

With the rise of more devices on networks, there is ever more data stored in different places. At the same time, we’re seeing a huge rise in malicious activity from those looking to hack networks to disrupt them and steal that data. As a result, data management and adjacent areas like data protection and analytics pose some of the most pressing areas in IT services today. Druva’s Singh estimates data management and protection as a $28 billion market opportunity at the moment.

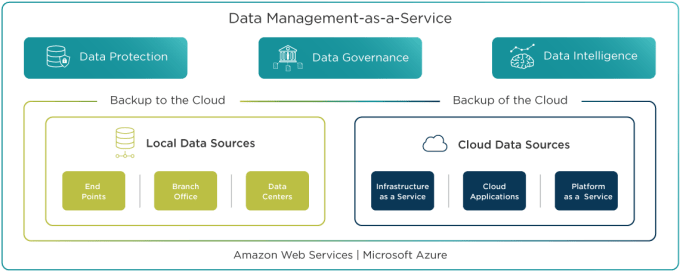

While there are a number of companies out there that are racing to fill that market need, the notable thing about Druva is that it has built a platform that’s aiming to provide several of these (and potential more) services all in one place: “data management as a service,” as the company describes it:

One area where Druva has been developing its services has been in growing the number of features that the platform provides: for example, earlier this year it started to offer a facility to protect data on its platform from ransomware.

“Historically, the cloud was synonymous with mobility and we focused on an under-served market for endpoint protection. Today, with broad cloud adoption, there is disruption in how data within core data center, brick & mortar, or cloud data can be protected,” Singh said about the company’s plans for further features.

Other areas include maximising what companies can get out of secondary data. “Data is the new oil, and backup copy has rich chronological records for the company – which has never been used for greater good,” he said. “Traditionally, hardware-software approach made it complicated, and IT had it’s own silos. With cloud, we wish to break that and help take the customer through a journey from data protection to data governance and finally to data intelligence.

While the company building all this into a bigger platform is one reason investors are interested, so is the company’s financials: currently the gross margin is over 70 percent and Druva has 100 percent recurring revenues.

“Cloud Data Protection and Management solutions are massively disrupting the secondary storage industry,” said Jeff Parks, co-founder and general partner at Riverwood Capital, in a statement. “Druva delivers an as-a-service protection and management solution for all enterprise data encompassing infrastructure, endpoints, and cloud applications. We are impressed by Druva’s ability to help organizations re-define their data protection and management strategy in a cloud first world leveraging the performance, scale, ease of use and TCO benefits of the public cloud and SaaS. The effectiveness of Druva’s technology has been lauded by a large list of customers. With high customer satisfaction, strong brand loyalty, proven technology innovation and seasoned leadership team, Druva is best positioned to drive the as-a-service transformation of enterprise data protection and management.”

Longer term, the company’s plans include the potential for an IPO, but Singh doesn’t rule out that there are other potential outcomes.

“We still believe IPO is the right outcome for the company,” he said. “Data protection is a massive market that is growing for cloud adopters. We are not limited [by a total addressable market] and have built an impressive execution engine to go capture this. As our opportunity is so large, our focus is simply on accelerating the growth of Druva versus on the exit strategy. An IPO is an option for us to consider as we build our company further, but it is one of many options available to us as we execute.”

Featured Image: Maciej Frolow/Getty Images