Cryptowestworld

Let me tell you a story. Once upon a time there lived a mysterious, brilliant inventor, now lost to history, who created a kind of autonomous zone wherein the traditional rules of governments and law did not apply. It was scoffed at as escapism, but over time it drew an ever-growing crowd who used it primarily to indulge their greed and lust. A few, though, believed it could be more than an outlet for debased desires.

These true believers hope to reshape the whole world for the better, but they cannot predict the anarchic, chaotic, emergent properties of the new way of being they have fostered — and the world resists, with extreme prejudice, any attempt to fundamentally change it. Will the new way prevail? Will the crazed greed-seekers find themselves bloodily downfallen? Will the world be changed? Tune in to binge-watch the next season when it drops!

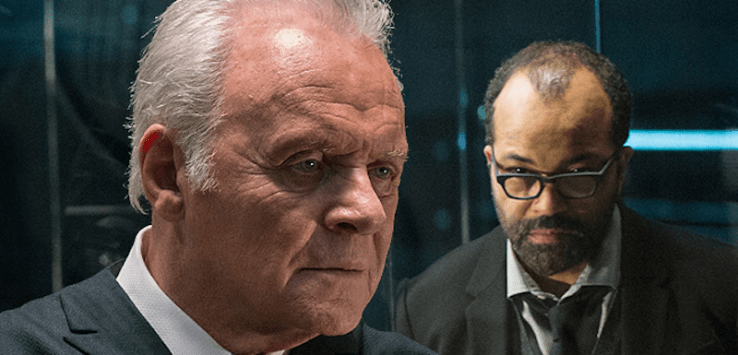

…Except we’re living that next season, of course. The plot summary above matches HBO’s Westworld … and it also matches the saga of Bitcoin and other cryptocurrencies over the last eight years.

Most of the masses flocking to cryptocurrencies right now aren’t particularly interested in the decentralization of locuses of power, or the “cryptoforming” of Inner Mongolia, or replacing networks with markets. They just want to get rich. VCs are flocking to a technology that is, according to its visionary believers, pretty much supposed to make VCs obsolete. Did you think “venture capitalist” was not one of the jobs at risk from automation? Think again…

It turns out that the killer app for digital money is money. Bitcoin as a kind of digital gold; Ethereum as a platform for the marketable securities called “tokens”; and a few other monetary niches here and there. Who’s currently using decentralized apps for anything else significant, at scale? Uh, well, actually, nobody, yet. But what does that matter? Look at those eye-popping valuations! Let the good times roll!

Except they might already be rolling a little too hard. There are a ridiculous number of crypto tokens and ICOs out there, most of them pretty obscure. Even if the technologies these tokens are meant to support are worthwhile, which is often at best questionable, early adopters only have so much mental bandwidth — and, as an interesting new study from MIT shows, just because your tech is good does not mean it will spread and win. Early adopters play a vital role in pollinating the larger world with new technology, like bees do in agriculture. Lose them and you’ve already lost everything.

A lot of extremely intelligent people are working hard on scaling these blockchains, with initiatives like Lightning and Plasma — write caches for which blockchains serve as the master repository, to greatly oversimply. The idea is to scale these payment networks to Visa-like levels of thousands of transactions per second, or far beyond, because the Bitcoin ambition a few years ago was to replace Visa and have people buy their coffees with Bitcoin. But it turns out coffee purchases are already a solved problem, unless you’re one of those crazed radicals who thinks that government-backed money is a scam about to collapse.

Instead, crypto went mainstream because Ethereum gave ordinary people the ability to trade in a whole new form of marketable securities, “cryptotokens,” which in theory will one day have some kind of inherent value. But it turns out governments tend to frown on unregulated securities markets, which is why the most responsible people in the space are restricting investments to accredited investors. A noble step in the direction of compromise, though it may not be enough.

But where next? In Westworld, the masses coming to the park to expiate their ids wound up subsidizing years of innovation that led to a resistance against the system which fostered that dehumanizing abuse. In Cryptowestworld, something very similar might be happening; the attention, innovation, and ridiculous quantities of money being poured into the space might help to kickstart some genuinely new, more equitable, decentralized financial systems. Let’s hope a killer blockchain app that is something other than a form of money arises. It would be a terrible shame if today’s crypto bubble was nothing more, in the end, than a crazy time for investors and day traders.