Alphabet keeps printing money despite a hefty $2.7B fine from the EU

Alphabet’s advertising business continues to grow at a mammoth pace despite a very hefty setback from the EU in the form of a massive fine — but all the signs might not be pointing to a perfect future for Google.

The EU slapped Google with a $2.7 billion fine at the end of June for antitrust violations pertaining to its Google’s Shopping search comparison service. Google baked that into its second-quarter earnings today, which still showed more than 20 percent growth in its revenue and a 52 percent jump year-over-year in the “paid clicks” — basically, Google’s eyeballs on its ads. It beat expectations across the rest of the board the rest of the way.

There is one maybe-overlooked part of Google’s report that we’ll highlight: The company’s “traffic acquisition cost,” or TAC, actually increased as a percentage of Google’s revenue year-over-year. It accounted for 21 percent of Google’s advertising revenue in the second quarter last year, and 22 percent in the second quarter this year. This may seem like a small jump, but a TAC cost that inches higher may not be a good sign and may be a negative signal to Wall Street.

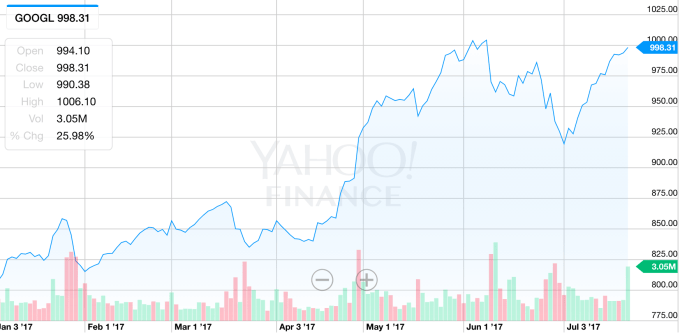

A little after the earnings report dropped, the stock fell as much as 3 percent. The company breached $1,000 per share today, but it looks like the story on this may need to play out before Google can continue its march upwards. Shares of Google are up more than 25 percent on the year despite having a somewhat rocky past month.

While that TAC jump is incremental, an increasing TAC may be a risk to Google going forward. That’s a fee that’s going to weigh on its balance sheet even as the number of eyeballs it gets on its ads continues to balloon. Google proper is still the company that will continue to drive Alphabet, even though it continues to explore new lines of businesses in its “other bets” like Nest. All this is happening while Google is tightening the belts of its extraneous projects as it looks to convert them into real businesses.

Google’s cost of revenue for the second quarter also ballooned to more than $10 billion, up from around $8.1 billion in the second quarter last year. Its revenue may have jumped 21 percent, but those costs are increasing faster than the increases in its revenue. All these are small signals, but they aren’t ones that Wall Street are going to ignore as it looks to properly price out Google’s future.

Google still wanted to bake that EU fine into its earnings to set expectations going forward. Wall Street is looking at today’s earnings report from Google through that lens, with the stock barely moving after the announcement came out. The company reported earnings of $5.01 per share on revenue of $26 billion. Analysts expected earnings of $4.46 on revenue of $20.9 billion.

Featured Image: AFP/Getty Images