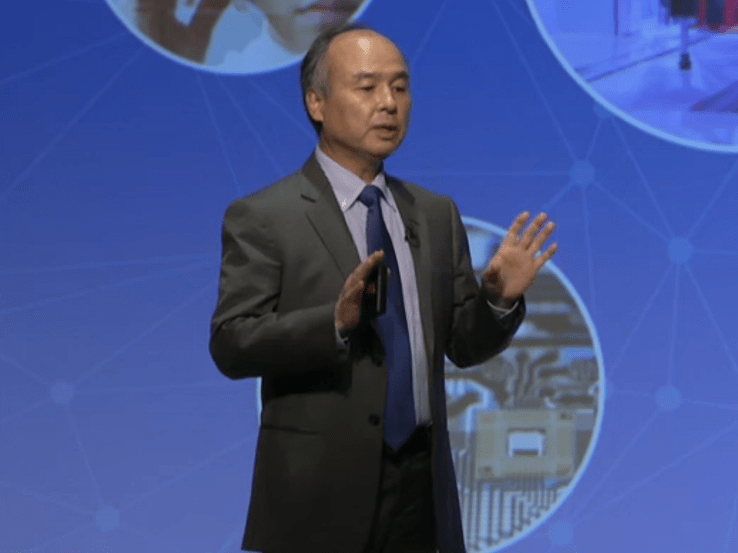

SoftBank CEO Masayoshi Son says he wants to invest in either Uber or Lyft

![]()

SoftBank has been heavily linked with an investment in Uber in recent weeks, and today CEO Masayoshi Son confirmed his interest in pursuing a deal. However, in a twist, Son said that SoftBank is also considering buying into Uber’s arch-enemy in the U.S., Lyft, instead.

Speaking to investors following the announcement of SoftBank’s Q1 2017 earnings, Son was candid about SoftBank’s desire to back a horse in the U.S. ride-sharing space. While it is the largest investor in Didi Chuxing (China), Ola (India), Grab (Southeast Asia) and 99 (Latin America), it doesn’t yet have representation in North America.

“We are interested in discussing with Uber, [but] we are also interested in discussing with Lyft,” Son said during a Q&A session. “We haven’t decided which way, but [the] U.S. is a very big market — it’s [the] most important market — so we are definitely very much interested in the U.S. market. Whether we decide to partner and invest into Uber or Lyft, I don’t know what will be the end result.”

Lyft recently hit one million rides per day, and its valuation is rising while Uber goes through a period of uncertainty without a CEO, but still its business is considerably smaller than Uber. Lyft closed $600 million in fresh funding at a $7.5 billion valuation in April, whereas Uber has been valued at over $60 billion. Its value is less certain now. Reports indicate, however, that SoftBank may do business at a lower valuation, and involve secondary share sales.

For all that talk it doesn’t appear that any kind of deal is on the table right now. Son himself said SoftBank is “exploring the idea and we would like to discuss with both companies.”

The idea of investing in Uber, which rivals Ola, Grab and 99 but was beaten by Didi in China, has surprised many, but throw in the fact that SoftBank is also weighing its rival and there’s likely to be further confusion over the motivation. However, Son explained that he sees ride-sharing as a key global industry that Softbank can ill-afford to miss out on.

“This is the shared economy and one of the most important industries, I think the way people use the transportation and the lifestyle will be different from today [compared to in] 30 years [or] 50 years,” he explained.

“The autonomous car is definitely coming, and when that stage comes, this ride-share business becomes even more important,” Son added.

SoftBank’s ride-sharing ambition — which has been clear for some time — sits outside of its enormous Vision Fund, which is targeting a $100 billion total raise and also has stakes in huge global companies like ARM and Nvidia.

SoftBank announced a first close of $93 billion for the fund in May, but revealed it will sit out ride-sharing deals due to conflicts of interest. That hasn’t stopped SoftBank from stepping up and financing billion-dollar funding rounds for Grab and Didi already this year, with other companies likely to be on the receiving end of additional financing.